China's walnut exports surge 80%, new season output expected to reach 1.5 million tons!

According to US agricultural media reports, Rabobank's North American Head of Food and Agriculture Research, Michel Fumasi, recently stated that global walnut consumption is on the rise, but the United States, the largest walnut exporter, has not benefited from this growth, as Chinese and Chilean walnut exports continue to take away US market share. Ten years ago, US walnut growers received purchase prices exceeding $1.80 per pound, but last year, these prices dropped to approximately 20 cents per pound. During this period, China's average walnut production increased by nearly 6%, while Chile's average production increased by 14%.

Fumasi stated that China's walnut exports have grown at an average annual rate of just over 30% over the past decade, while Chile's exports have grown at an average annual rate of 14.3%. During the same period, the US's average annual growth rate was only 4.6%. While prices paid to US walnut growers are expected to increase, all other indicators, including consumption and exports, continue to decline.

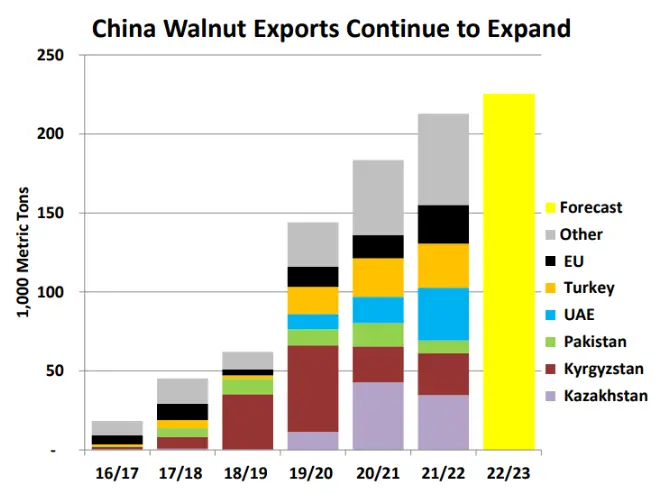

The USDA's previous report, "World Tree Nut Markets and Trade," showed that China was the world's seventh-largest walnut exporter in the 2016/17 season, with exports of only 18,000 tons. By the 2019/20 season, China had become the second-largest walnut exporter after the United States, with exports reaching 144,000 tons. This impressive growth was attributed to China's exports to neighboring emerging markets such as Kazakhstan, Kyrgyzstan, and Pakistan, where the walnut market is less competitive. China's walnut exports have also expanded to top global import markets such as the European Union, Turkey, and the United Arab Emirates.

As the world's largest walnut producer, China is well-positioned to continue expanding trade with neighboring countries. However, whether China will continue to expand its market share in major global markets such as the EU, Turkey, and the UAE remains uncertain, as China primarily cultivates over 50 indigenous Walnut Varieties characterized by dark-colored kernels and a bitter shell. With an eye toward future development, the China Chamber of Commerce for Import and Export of Foodstuffs, Native Produce, and Animal Products is drafting industry standards for grading walnuts to improve export quality and consolidate China's position in these markets.

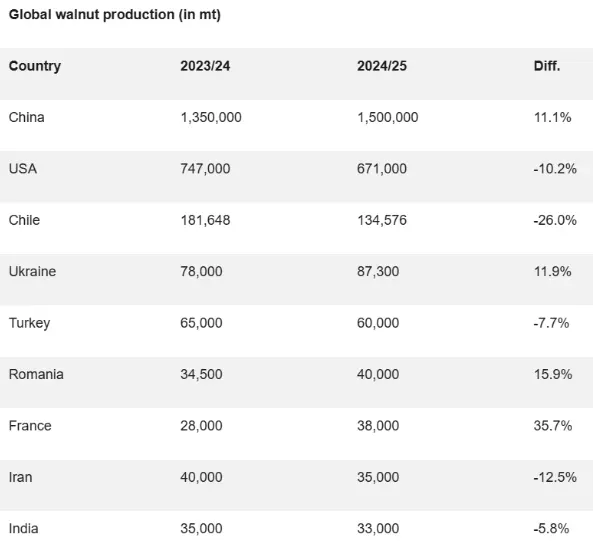

According to the International Nut and Dried Fruit Council (INC), China's in-shell walnut production in the 2023/24 season is estimated at 1.35 million tons, a slight decrease of 3.6% compared to the 2022/23 season, but it will remain the world's largest walnut producer for that season. China's walnut exports set a new record in 2023, with in-shell walnut exports increasing by 80% and shelled walnut exports by 61% compared to 2022. According to Chinese customs statistics, China exported 76,347 tons of Unshelled Walnuts worth RMB 1.13 billion in 2022, and 38,442 tons of walnut kernels worth RMB 1.13 billion. In 2023, China exported 137,538 tons of unshelled walnuts worth approximately RMB 1.75 billion, and 61,872 tons of walnut kernels worth RMB 1.66 billion. China's walnut exports are currently performing well, with stable prices. This trend is expected to persist throughout the season, as inventories are lower than last year.

The association's new season forecast, released during its Vancouver conference in May, projects an 11% increase in China's in-shell walnut production in the 2024/25 season, reaching 1.5 million tons, with the country's market share expected to further expand. In contrast, the US is facing difficulties in the new harvest due to poor weather conditions, with production expected to decline by 10% to 671,000 tons. Chile's production is also expected to decline by 26% to 135,000 tons. Global walnut production, calculated on an in-shell basis, is projected to decline slightly by 0.6% in the 2023/24 season, from 2,654,294 tons in the 2022/23 season to 2,638,788 tons. Both global walnut production and supply are projected to increase in the 2024/25 season, with production expected to rise slightly by 2% to 2.7 million tons and supply to rise by 8% to 2.9 million tons. Production in Ukraine, the fourth-largest producer, is projected to increase by 11.9%, but in Turkey, the fifth-largest producer, production is projected to decline by 7.7%. Among European producers, Romania, France, Moldova, and Italy are all expected to see double-digit growth, boosting Europe's overall supply.