Impact of US tariffs on nut trade in 2025

In early 2025, the U.S. government under President Donald Trump implemented significant tariff measures affecting imports from Canada, Mexico, and China. These measures, designed to address trade imbalances and protect domestic industries, have had a severe impact on the U.S. agricultural sector.

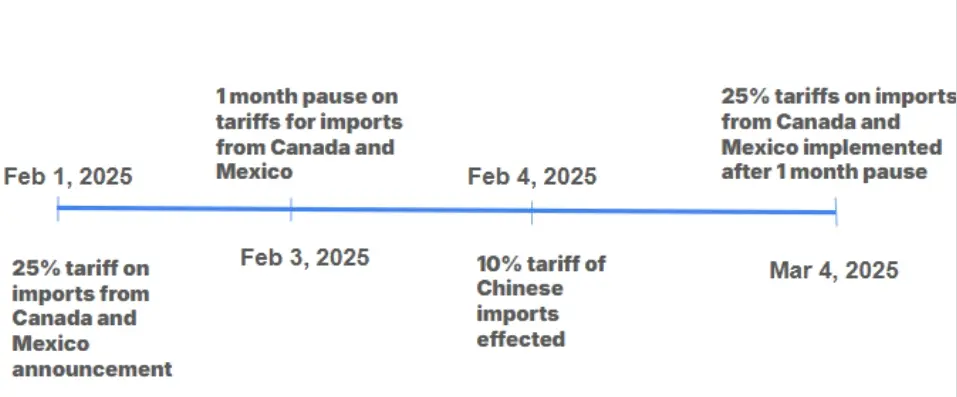

Tariff Imposition and Adjustment Timeline:

February 1, 2025: The U.S. President signs an executive order imposing a 25% tariff on all imports from Canada and Mexico, with tariffs on Canadian energy resources reduced to 10%. In addition, a 10% tariff is imposed on all imports from China. These tariffs were initially scheduled to take effect on February 4, 2025.

February 3, 2025: The United States announces a one-month suspension of tariffs on Canada and Mexico after the two countries agree to strengthen border enforcement measures. As a result, tariffs on Canadian and Mexican imports are postponed until March 4, 2025.

February 4, 2025: The additional 10% tariff on Chinese imports takes effect as scheduled.

March 4, 2025: After a one-month suspension period, 25% tariffs are imposed on imports from Canada and Mexico.

Timeline of the U.S. government's tariffs on Canada, Mexico, and China as of March 4, 2025

April 2, 2025: Trump announced at the White House that he would impose so-called "reciprocal tariffs" on trading partners. It is planned to impose a 34% tariff on China; 20%-49% tariffs on trading partners such as the European Union, Vietnam (46%), Taiwan, Japan, India, South Korea, Thailand, Switzerland, Indonesia, Malaysia, Cambodia (49%), and the lowest reciprocal tariff rate for any trading partner is also 10%.

According to statistics from a research institute, if the reciprocal tariff plan is implemented, combined with the previous tariffs imposed on individual countries (Canada, Mexico, China) and tariffs on specific products such as steel, aluminum and automobiles, the actual tariff rate on all imported goods in the United States will rise from 2.3% at the end of 2024 to about 26%, reaching the highest level in 131 years. Among them, the tariffs imposed on China this year have reached 54%. If the tariff level imposed by the United States on China in 2018 is added, it has significantly exceeded 70%, which is appalling. Its specifications have far exceeded the trade war in 2018.

In response, at 18:00 Beijing time on April 4, China announced that it would impose a 34% tariff on all imports originating from the United States starting from April 10, on top of the current applicable tariff rate, without any exemptions.

Retaliatory tariffs threaten US nut exports to China

According to the ITC trade map, in 2024, China, Canada and Mexico will be the second, ninth and twelfth largest export destinations for US nut exports (HS code: 0802), respectively. In terms of nut varieties, almonds account for nearly 70% of US tree nut exports, while walnuts and pistachios account for more than 10% and 9%, respectively. Therefore, any retaliatory tariffs from these three countries will mainly affect these three nut varieties.

U.S. nut exports to major destinations in 2024

According to the Almond Board of California, recent shipment data highlights the United States' growing reliance on the Canadian and Mexican markets, with total shipments for the 2024/25 year-to-date reaching 37.79 million pounds and 21.35 million pounds, respectively, up 12.3% and 16% over the past three years. The growing importance of these markets to U.S. almond suppliers underscores the impact that tariffs could have.

This scenario could lead to retaliatory tariffs from both countries, with two main outcomes: an oversupply in the U.S. domestic market, which could lead to lower prices, and Chinese, Canadian, and Mexican importers looking for alternative suppliers. Both outcomes could lead to lower profit margins for U.S. producers. However, a deeper analysis shows that both outcomes have limited impacts on prices and trade.

First, retaliatory tariffs will not significantly change the Canadian almond trade. With the U.S. accounting for a large share of the Canadian market, it is unlikely that Canadian importers will stop sourcing U.S. almonds. According to the ITC Trade Map, in 2024, Canada imported $138.04 million worth of in-shell and shelled almonds, of which $135.7 million came from the U.S., with a market share of 98.3%. That being said, Spain, which accounts for 1% of the Canadian almond market, may see a slight increase, but the United States will remain the main source of Canadian almonds due to its proximity to Canada and the high quality of its almonds. The situation is similar in Mexico, where all of its imports of shelled and kerneled almonds worth $23.24 million in 2024 come from the United States, highlighting the lack of major competitors to the United States in both markets.

Will China stop buying American almonds?

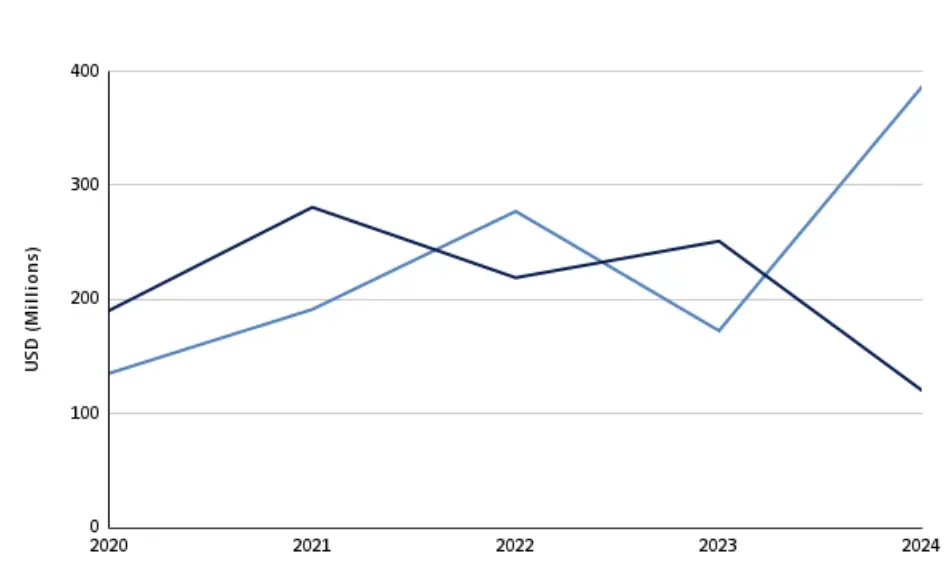

However, the situation in China is different. If China imposes retaliatory tariffs on US imports, US almond suppliers may lose a place in the Chinese market as China is shifting from its previous reliance on US almonds to Australia. According to the ITC Trade Map, in 2024, China imported US$120.03 million worth of US almonds (shelled and shelled), a sharp year-on-year decrease of 51.2%. On the other hand, in the same year, China imported US$386.94 million worth of Australian almonds (shelled and shelled), a sharp year-on-year increase of 124.2%. Therefore, retaliatory tariffs on US imports could cause Chinese importers to choose Australian almonds, further reducing US market share in China.

At the same time, the share of US Shelled Walnuts in China dropped sharply from $4.6 million in 2020 to $300,000 in 2023, and Chile took the opportunity to take 95% of the market; in 2024, Kyrgyzstan exported walnuts (shelled) worth $2.44 million, exceeding the US's $1.17 million and comparable to Chile's $3.24 million. This is the first time Kyrgyzstan has entered the Chinese market, and whether this momentum will continue in 2025 remains to be seen. Even the traditional US advantage product, shelled pistachios, is facing strong catch-up from Iran - in 2024, China's pistachio imports from Iran surged 150% year-on-year. With the implementation of China's 34% tariff on the United States on April 10, this "de-Americanization" trend may accelerate.

It is worth noting that the strategic shift in the Chinese market has limited impact on the overall US exports. Taking walnuts as an example, China only accounts for 0.3% of the US global exports. Even if it withdraws completely, the United States can still digest production capacity through Canada (US$62 million) and Mexico (US$75.6 million). Pistachio producers have begun to break into Europe: Germany's imports of shelled pistachios have soared 58.9% in two years, Italy's demand for shelled products has surged 61.77%, and the Spanish market has also grown steadily. These emerging growth poles are becoming a safe haven for American nut traders.